Even if you don't

take intraday trades, or don't have any idea about Market Profile whatsoever,

being able to predict the smart money activity can be a massive benefit to your

trading and investment.

It's important

to understand that two herds exist in the market:

1.

Smart Money and

2.

Dumb Money

"Smart Money" refers to

institutional investors, big sharks who have money and information power who

give direction to markets. In the Market Profile world, we call them as Other

Time Frame (OTF) participants.

"Dumb Money" refers to

nonprofessional traders, retail traders who often want to quick money.

Market Profile helps us identify and differentiate the

activities of the "smart money," and hence we can identify many

profitable trade opportunities.

Introduction

Market Profile is a

technical concept with a unique charting technique developed by Peter

Steidlmayer when he was trading at the Chicago

Board of Trade (CBOT), and it was open to the public

in 1985. Market profile is a style of plotting price on the Y-axis and time on

the X-axis (Generally 30 minutes is considered as one session), which most of

the time form a bell-shaped image as the body of the profile.

The three

essential components of the auction process are (in the same order of

importance):

1. Price—it advertises

all the opportunities.

2. Time—it regulates all

the opportunities.

3. Volume—it measures the

success or failure of all the advertised opportunities.

Market Profile gives more importance to "TIME"

as compared to "VOLUME." There are many

reasons for this:

·

Volume is essential as 80% of

the trading volume is given by 20% of the big players. However, time also plays a crucial role, because a

price that is not accepted over time is the sign of rejection of that price

level.

·

A spike in volume can only be seen after a big move in the price. Hence, many times intraday traders and short term traders may not

be able to reap the benefits.

·

In intraday trading, the opportunity

is inversely proportional to time. Day traders, especially options traders, should know the

importance of time. Option buyers will lose the money if the price doesn't

show a quick move, and similarly, the Option seller will lose significant money

if the price shows a rapid movement.

·

On any trading day, long -liquidation or short-covering rally

generally happens due to the result of time running out for day traders,

rather than a lack of volume. Very rarely, these situations are caused by a

combination of both factors.

This article

aims to give market profile outsiders a no-nonsense four-step in detailed

explanation to understand the market profile in a better way.

Step-1 Candlestick vs. Market

Profile chart

Many traders don't

understand the influence of time on both the price and opportunity. An

attractive opportunity to buy the below

value or sell the above value will not

last long as smart money will act very quickly, and their position size

pushes the price very soon to the other side.

Image 1: Candlestick

chart.

In a candlestick

chart, Price variations are plotted

in 'Y' axis against the Time 'X' axis. In this type of chart, time remains constant throughout the price variations, which means we

are not using the time parameter effectively.

Assume one

person wanted to travel from Delhi to Mumbai, and you are allocating 2-hours

for this journey. Another person wanted to fly from Delhi to Melbourne, and

again you are assigning 2-hours for this journey. It is not a wise move as

Melbourne is very far as compared to Mumbai from Delhi, and definitely, the second

person needs more time allocation to

reach that place.

However, for the

first person, 2-hour is enough to reach

Mumbai from Delhi on a flight. In other words,

it is sensible to allocate the time based on the distance to be covered in the

journey and not just giving fixed time to all journey irrespective of the

distance.

Image 2: Nifty

20-12-2018 30-min candlestick chart showing the same time allocation.

Image 2 shows a

Nifty 30-minute candlestick chart for the day 20-12-2018. In the middle of the

session, we have a small candle with an entire

range of 10 points, and in the end, we

have a big candle with a big range of 46 points. If you look at the time axis,

the amount of time allocated to both these candles are the same! It gives just

a 2D view on the price auction with respect to time.

In the first

case, 30-minutes price auction resulted in a 10 points range, and in the second

case, 30-minutes price auction resulted in 46 points. Do you think price auction with respect to time is the same in both cases? Don't you think we are

missing some crucial information? Just recall Delhi to Mumbai and Delhi to

Melbourne's journey example in the previous paragraphs.

Image 3 – Nifty

20-12-2018 Market Profile chart showing different time allocation.

Now look at the

same day in a market profile chart in image

3, it is evident that the time has been allocated effectively based on the

price variations. It gives a 3D view of the price auction with respect to time.

Also, you can see the Value Area, unfair

high, unfair low, and even point of control (POC).

Point of Control

(POC) is the price level in which maximum time

was spent (Price Profile) or maximum trading activity (Volume Profile) occurred

on any day.

Value Area (VA) is the 70% price range around POC. It is the fair price of the

Nifty on this particular day. VAH and VAL are the upper and lower boundaries of

Value Area respectively.

The construction

of a market profile chart is easy. Click

here if you want to know how to construct a market profile chart.

Step-2 Edge in Market Profile

The marketplace is full of different players

like long-term buyers, long-term sellers, scalpers, intraday traders, swing

traders, Positional traders, etc. The combined action of these players together

is the main reason behind price fluctuations.

Image 4: Market

activity in a day.

Big buyers and big sellers (two entities of

smart money) will execute their plans at different price levels, and they cannot

trade with each other at the same price level. Other participants (most of them

are retail traders) act as a bridge between these two payers by providing

liquidity for both these players, as shown in the above image 4.

Let's say a script is trading at 100. Long-term

buyers will have a plan to buy this script only below 50, and long-term sellers

will have an intention to sell this script just above 150. If we restrict the

trading activity in this script only to long-term buyers and long-term sellers

(OTFs or two entities of smart money), the price will be stuck at 100 as both

of them don't have plans to trade at this level.

If we allow other players such as scalpers,

retail traders, swing traders etc. then they provide liquidity to the market.

Their participation will take the price to either 150 or 50 depending on the

combined effort of all other traders except the OTF's (smart money). If the price reaches 50, long-term buyers

(OTF Buyers) will pitch in, and if the price reaches 150, long-term sellers (OTF

Sellers) will pitch in to initiate their trades.

The entry of these big players can be

identified through certain Market Profile concepts such as Extremes, Range

Extension, TPO Count. All these concepts indicate that whether the price is

getting accepted or rejected.

If you want to get success in intraday trading,

then you have to stop taking trades in between the value. Besides, one can look

for smart money entry patterns at the critical price levels. The next step

explains this concept in detail.

Step-3 Initiative and

Responsive Activities

On any trading day, it is

essential to know whether smart money is

acting on their initiative, or they are just responding to excellent

opportunities. It can be done using current day price auction with respect to the

previous day value area/range.

What is Responsive Activity?

It is a good

idea to explain this concept with a real-life

example first.

For a moment,

assume you are an iPhone dealer, and your main job is to buy and sell iPhones.

Besides, also imagine there will be

enough buying opportunities and selling opportunities (as we are comparing this

example with the market and there will be enough buying and selling opportunities

in the markets too).

Currently, iPhone 6S is

trading in the range of Rs. 25,000 – Rs.30,000 in India. This price might vary

in different parts of India based on the availability and due to many other

reasons. However, we consider this is the price range for iPhone 6S. It is the Value

Area for iPhone 6S.

Image 5 –

Responsive Activity

In normal situations, whenever the price trades at Rs 25,000 (or

below), it is a good idea to buy as the price is near the lower band and you

can expect price movement up to Rs 30,000, and you will get a profit of

Rs.5,000 or more if you sell at (or above) Rs 30,000. It is one type of Responsive Activity, and more

specifically, it can be called as Responsive Buying.

Similarly, when the price trades at Rs 30,000 (or above), it is a

good idea to sell your holdings, and you can also go short. You will anticipate

the fall of up to Rs 25,000, and you will make a profit of Rs.5,000 or more if you close your position at Rs 25,000

(or below). It is also another type of Responsive

Activity, and more specifically, it can be called as Responsive Selling.

This situation will continue until some significant news breaks out.

It can create an imbalance in the price, and those imbalanced situations lead to the Initiative activity later on.

What is Initiative Activity?

We will continue

with our iPhone example, and we have to make one assumption. Imagine, suddenly,

Apple has decided not to supply iPhones to India (for some reason) for next

year. As a premier dealer, you got the information from a closed source, and

this information is yet to come in the news.

Now, what do you

think, and how do you react to this situation?

Do you think buying

more iPhones even at a higher cost (to accumulate for one year) as demand will

increase due to the shortage of supply, and thereby you can sell it at the time

of shortage even at a higher price, right?

However, the

current market price of the iPhone 6S is already at Rs 31,000. Do you still buy

it at this price level?

If your answer

is YES, then it is called Initiative

Activity and, more specifically, Initiative Buying!

Image 6 shows

the explanation for the Initiative Buying scenario.

Image 6 –

Initiative Buying

Now, it's time to make one more assumption. For some reason, the

central government has decided to ban the iPhone 6S!

However, the

price is trading near 25,000.

What do you do

at this moment?

Do you buy

iPhone 6S, or do you sell at any price?

I am sure you

decide to sell iPhone 6S at any available price, right?

It is another

form of Initiative Activity and, more

specifically, Initiative Selling!

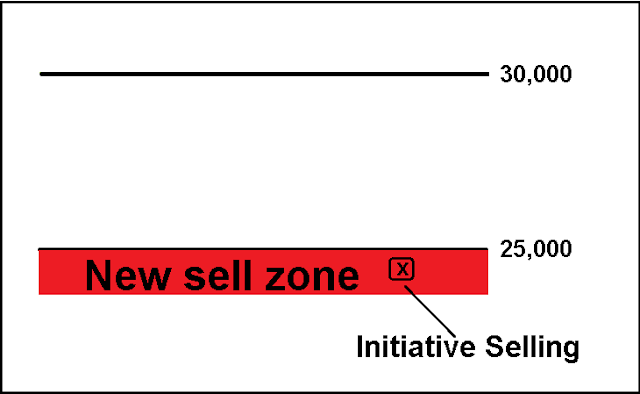

Image 7 shows

the explanation for the Initiative selling scenario.

Image 7 –

Initiative selling

Step-4 Smart Money in Action!

If you can

differentiate the Initiative activity and Responsive activity, then you can

easily predict the plans of smart money. In most of the situations, an

Initiative action is more potent as compared to Responsive Action (except at major

reversals). Hence, it is good to spot Initiative Action so that traders can apply trending strategy to take

the trades in the direction of Initiative activity to get the maximum

benefits. Besides, they can deploy the mean

reversion technique for responsive activity.

As you know,

when the price opens above previous day value area or previous day range, it

attracts Responsive sellers (at the moment we are not sure whether its smart

money and their real intention to cause it) and price auction downwards until

it draws the buyers.

Image 8 – Price

open above previous day range

Image 8 shows

that the price is opened above the previous day range, and this indicates that

some Initiative buying has been involved in this process before the open, but

we don't know their real intention.

As the price is

opened above the previous day range, it immediately attracts Responsive

Selling.

Now, after 15

minutes from the open, the price is still trading above previous day range,

what this indicates?

It indicates

that the Responsive Sellers are absent or Responsive Selling is not as powerful as Initiative Buying!

As explained

earlier, the market profile gives more importance to time over volume as the

price level, which is not accepted over time, will be rejected. Also, time is the

most critical parameter for an intraday

trader as compared to volume.

In the above

case, the price opened above the previous day range, and it advertised an

opportunity for responsive activity. However, the price stayed above the previous

day range for 15 minutes. It indicates the absence of responsive activity or

lack of strength in responsive activity. It confirmed that the initiative

buyers are involved in this process to drive the prices up.

So in this case,

taking a Long trade, keeping stop-loss a few

points below the open or previous day high makes

sense. One should carry their trades until End of Day with trial stop-loss

concept as Initiative activity always gives their close at peaks.

Image 9 –

Responsive Selling with open-high and open-test-drive-down

Now in a similar

scenario, if the price opens above (or near) previous day high and if it shows

open-high or open-test-drive-down open on a 15-minute chart, then it indicates the failure of initiative

buying as the price is getting rejected. It confirms only responsive selling is

the remaining option for the rest of the day. Hence, intraday traders can

plan a short trade below the low of the 15-min candle, keeping a strict

stop-loss above 15-min candle high or above few points above the previous day

high, and they can target value area low or previous day low as the target.

The proper knowledge of the price auction around a

reference point is very crucial to differentiate an initiative and responsive

auction and to make successful trades. If

you want to become a successful intraday trader, then you should deploy a trend

following trading technique during initiative setups and mean reversion trading

techniques during responsive trade setups.

Do you think you get some fundamental clarity

on the market profile?

Do you still have any doubts?

If yes, please leave your comments!

Indrazith

Shantharaj is Market Profile Trader and Author of two Trading books, "Trade

and Grow Rich" and "Mind Markets and Money."

Nice article 👍🏻

ReplyDeleteGives all initial insights of Market and understanding on intraday trading opportunities.

Thank you 😊

Thanks Keerthi!

DeleteSuperb!

ReplyDeleteI never knew this way of trading exists. Thanks a lot for this useful information

Welcome!

DeleteNicely explained .

ReplyDeleteThanks!

DeleteExcellent article.Where can we read more about market profile?

ReplyDeleteI can suggest 3 sources:

Delete1. Mind Markets and Money book (kindle book is just Rs. 98)

2. Mind Over Markets book

3. https://www.profiletraders.in/Pages/ArticlePage

You can also read the first chapter of my book for free on my home page (above link).

Nice article. .Understood most of it . But Pls explain the overlapping alphabets in the 30 mins time frame during the day.. I'll really appreciate if you can explain this part to me in a layman's language .Thnx

ReplyDeleteIts called as TPOs.

DeleteThey give the Point of Control (POC) and Value Area.

POC is the price level in which the script has spent more time. Hence, it plays a crucial role on the next trading day (one example is it is safe target in case of a short trade at PDH as responsive selling etc).

TPO also gives idea on Extremes, Single Prints which indicates the presence of "smart money". So, we should be ready to act quickly if price reaches this level.

I tried my level best to answer your question in this small space!

Nice article, is it similar to Volume profile, if not then what is difference?

ReplyDeleteNice article, is it similar to Volume profile, if not then what is difference?

ReplyDeleteMarket Profile is different from Volume Profile.

DeleteVolume Profile just gives importance to Volume. Whereas, Market Profile is a big topic!

Please check the below important concepts of Market Profile (You can google it or you can read any book):

- Initiative and Responsive activity

- Balanced and Imbalanced Market conditions

- Day Structures

- Open Types

- Market Sentiment

I hope this helps!

Excellent article, got across the concept in simple terms

ReplyDeleteThank you!

DeleteExcellent article and well explained...!!!

ReplyDeleteThank you!

ReplyDeleteSir plz explain one scenario when market opens below the low of previous day.

ReplyDeleteA Good Question!

DeleteWhen the market opens below the low of previous day, it advertises opportunity for two people:

1) Responsive Buyers and

2) Initiative Sellers

If the Responsive Buyers are strong, then they should act immediately (because price opened below previous day low). Hence their action will take the price to previous day range within a few minutes after the open.

Assume, even after 15-30 minutes after the open, the price still trades below previous day low. Then this indicates "price acceptance" which is nothing but responsive buyers are not strong enough and sellers will take control for most of the day (high probability).

So, one should look for a short trade with good risk-reward.

Please refer the below article if you need more information - https://www.profiletraders.in/Pages/Article1?aa=How-to-Pick-an-Initiative-Trade-at-open-Part-2

Best simplified market profile explanation. I trade FSTE but cannot find market profile data on it. Any ideas why or where i should be looking please?

ReplyDelete